A new report from the United Nations Office on Drugs and Crime provides evidence Papua New Guinea could be missing out on billions of Kina in taxes and royalties from the logging industry.

The report reveals over a five year period from 2018-22 there was a a huge US$1.5 billion discrepancy the prices declared for log exports from PNG and the prices declared by Chinese importers.

This suggests logging companies in PNG could be failing to declare over K1.2 billion in income every year, depriving the government of vital tax income and denying communities millions of Kina in timber royalties.

The report findings back up comments made in 2021 by the head of the Internal Revenue Commission, Sam Koim. He said in a statement that logging companies are guilty of “an entrenched level of tax evasion” with “egregious incidents of transfer pricing and under declaration of income”.

The UNODC findings are based on a ‘mirror analysis’ of trade data from PNG and China, which is the largest importer of PNG logs, taking around ninety percent of total production every year.

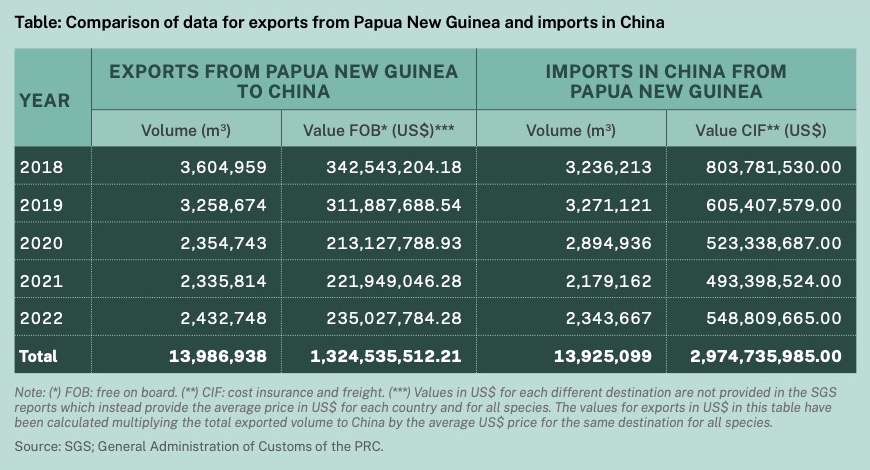

According to PNG export data, which is based on information provided by logging companies, the total value of the 13.9 million cubic metres of logs exported from PNG to China between 2018 and 2022 was US$1.3 billion.

Yet, according to import data from the Chinese customs service, the price paid for those same logs by customers in China was almost US$3 billion.

Once the differing export and import prices are adjusted to take account of the costs of insurance and shipping from PNG to China, the difference, says the UNODC, is a staggering US$1.5 billion.

By under declaring the price paid by its customers, logging companies in PNG are able to avoid paying log export taxes and royalties on the difference. They are also able to avoid corporate tax by not declaring any profits and, according to the IRC, they make inflated claims for GST refunds.

The use of transfer pricing by the logging industry was first identified by the Barnet Commission of Inquiry as long as as 1988, but 35 years later it seems the PNG authorities are still failing to combat the problem.

The IRC has pointed a finger of blame at the PNG Forest Authority for being too heavily influenced by the logging industry and not doing its own independent checks before log export permits are approved.

In 2023 the IRC announced a K140 million tax assessment against one leading logging company for tax evasion but it is not known if that penalty was ever paid. The IRC also said it was auditing the records of twenty other logging companies suspected of tax fraud, but the outcomes of those audits have never been revealed.

The Bank of PNG’s own money laundering risk assessment has identified illegal logging as one of the major money laundering risks in the country but commercial banks, law firms and accountants continue to provide their services to the industry.

Meanwhile PNG is at risk of being internationally sanctioned for its failure to combat money laundering, with its failure to publish a specific risk assessment and action plan for the logging industry one of the highlighted problems.